Nerfonomics

- Thread starter Nerf Herder

- Start date

-

- Tags

- economics george costanza nerf

Squidfayce

Eats Squid

just move to Brisbane! easy peasyThere are no 1 bedroom units in Sydney within an hours travel of the CBD for $500K or less.

Flow-Rider

Burner

I'll just state the obvious, If you already have a high paying job, you won't have any problems servicing a higher loan.Can I point out that the cities withafforablecheaper houses are the same ones with low paying jobs.

PS

There are no 1 bedroom units in Sydney within an hours travel of the CBD for $500K or less.

I know of someone with a $1M, near as fuck is to swearing, home loan. They sold their last place for a $270k profit. Burned that buying a family car using the lot and will then throw another $250k into a leased car for hubby. Combined income? Under $200k pa. Got me confused.I'll just state the obvious, If you already have a high paying job, you won't have any problems servicing a higher loan.

Flow-Rider

Burner

That's the type of stuff my brother does, owes banks and ATO a shit ton of money and then buys a 8k bed suite.I know of someone with a $1M, near as fuck is to swearing, home loan. They sold their last place for a $270k profit. Burned that buying a family car using the lot and will then throw another $250k into a leased car for hubby. Combined income? Under $200k pa. Got me confused.

See comment about low paying jobsjust move to Brisbane! easy peasy

downunderdallas

Likes Bikes and Dirt

I'm pretty sure Perth and Darwin win the average salary to average house price equationSee comment about low paying jobs

Squidfayce

Eats Squid

Just move two families into the one house. Easy.See comment about low paying jobs

Ultra Lord

Hurts. Requires Money. And is nerdy.

Have they even tried not being poor though?Just move two families into the one house. Easy.

Flow-Rider

Burner

He just jealous because they haven't borrowed to the hilt, the guy is living a dream now, even fairy tail I would say. Most of his kids have grown up and moved out, he used the money he saved to start a glazier business. I'm not sure if they're still living with that arrangement but they were still better off doing that, than rent a home and waste money.Have they even tried not being poor though?

Squidfayce

Eats Squid

I'm jealous? LolHe just jealous because they haven't borrowed to the hilt, the guy is living a dream now, even fairy tail I would say. Most of his kids have grown up and moved out, he used the money he saved to start a glazier business. I'm not sure if they're still living with that arrangement but they were still better off doing that, than rent a home and waste money.

pink poodle

気が狂っている男

Fuck me...dollar took a 5% dive against the yen in a day. I love an unexpected change in central banking fiscal policy.

Flow-Rider

Burner

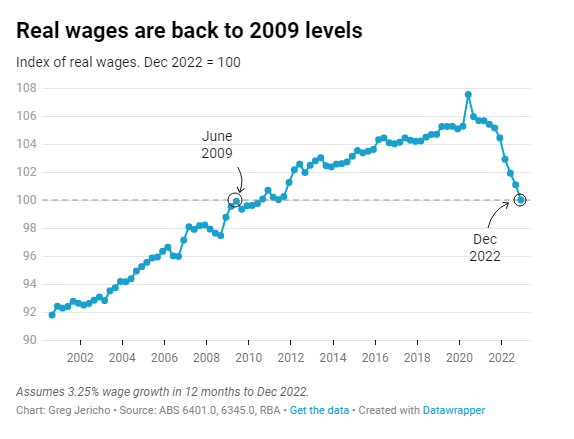

Inflation ate up wage growth.

"The Reserve Bank predicted that wages would grow by 3.1% in the 12 months to December. They actually rose by that amount in the year to September, so even if we assume a better-than-predicted wage growth in 2022 of 3.25%, that would still mean real wages are now back where they were in June 2009:"

Inflation looks to have peaked but the RBA set to keep raising rates

"The Reserve Bank predicted that wages would grow by 3.1% in the 12 months to December. They actually rose by that amount in the year to September, so even if we assume a better-than-predicted wage growth in 2022 of 3.25%, that would still mean real wages are now back where they were in June 2009:"

Inflation looks to have peaked but the RBA set to keep raising rates

Flow-Rider

Burner

I would say so, the problem isn't so much future rapid inflation at this point in time but the cost of living for many is so high ATM. If you have a look at where most household's income gets spent, those expenditures are very high in value., things like rents, insurances, health services.As expected another rate rise. Methinks RBA chicken to do a 0.5% with rubbery data, but gonna raise a bit and send warning shots of more to come.

Flow-Rider

Burner

People were very gullible in thinking that the official cash rate would remain low, but it's a catch 22, if they let inflation runaway people become poor like the wage chart I posted above. The govt could have intervened with policy to cap prices on necessity goods.What’s the rba thinking. Interest rates are definitely slowing spending. The figures I’ve heard on repayments for people are astronomical.

Squidfayce

Eats Squid

And what about the costs to produce those goods having gone up? Who pays that bill?The govt could have intervened with policy to cap prices on necessity goods.

There's no silver bullet. I read a headline today that sums it up - "too much, too late"

Flow-Rider

Burner

It's no different from one company undercutting another by working cheaper. The economy is just one big pyramid, they've cut the price of transport containers and fuel, how much of this has reached retail?And what about the costs to produce those goods having gone up? Who pays that bill?

There's no silver bullet. I read a headline today that sums it up - "too much, too late"